FINANCIAL AND INSURANCE SERVICES SALES PROGRAM

SALES TRAINING FOR FINANCE AND INSURANCE SECTORS

The banking and financial services industry is increasing at an extraordinary rate.

Since June 2020, the total size of Australia’s financial services market has increased by $1.27 trillion to a value of almost $10.9 trillion in June 2021 (source: Roy Morgan). The adoption of fintech services and an array of online solutions is disrupting the banking and financial services industry.

So what does this mean for the finance and insurance sectors and their ‘bricks and mortar’ retail stores?

In essence, it means reduced foot traffic, increased customer expectations and greater competition.

For sales teams, it means finding more innovative ways to reach new customers, identify new opportunities with existing customers and clearly articulate their point of difference.

"In order for finance and insurance services sales teams to become more innovative, sales teams need to be highly skilled in understanding and identifying their customers' needs, and the sales training needs to meet a variety of complex requirements."

OUR FINANCIAL AND INSURANCE SALES TRAINING IS DESIGNED AROUND THE FOLLOWING FIVE PRINCIPLES

#1

Legislation around financial and insurance institutions has changed the way you can 'sell'.

As a result of the banking royal commission, the COVID-19 pandemic and tighter security and privacy measures, financial and insurance institutions need to be compliant across a range of legislation including Anti-Money Laundering (AML) and Counter Terrorism Financing (CTF), as well as the Privacy Act, Anti-Hawking, Duty of Disclosure, Deferred Sales, General / Personal Advice. Financial and insurance institutions can be slapped with extensive fines for being non-compliant.

Shine Executive will work with you and your legal teams to ensure legislative requirements are taken into account.

“Naomi was knowledgeable with real hands-on experience. She is engaging and makes sense. A great opportunity to reflect on current skills, share the best practice and plan to move forward.”

Deb Parker – Heritage Bank

#2

Financial and insurance institutions need to uphold their brand values, and communicate their unique point of difference.

We recognise the importance of maintaining and communicating your unique point of difference in a highly competitive and ‘noisy’ industry. Afterall, it’s your values and brand integrity that has likely impacted your customer’s decision to put their trust in you.

At Shine Executive, we teach your salespeople how to weave your unique brand values into the sales process and the various sales pitches. Not only will your sales people be reaching their own individual KPI’s, but your organisation will also be creating greater integrity through the brand-building sales process.

“Naomi is a wonderful facilitator – she was open, honest and optimistic. She used real life examples that were relatable in practice.”

Mariah Smith – Aurizon

#3

Sales training needs to be flexible enough to successfully train sales staff at all levels of the organisation, from the new-sales-starter to the seasoned-sales-leader.

Financial and insurance institutions are complex workplaces, employing people for a diverse range of roles – from call centre staff dealing with customer enquiries to front-facing bank tellers performing day-to-day transactions and business banking managers involved in complex borrowing requirements. Poor or inconsistent performance from team members who are not trained properly or don’t have the right attitude can lead to a drop in employee engagement which then impacts the sales process and contributes to a higher churn rate.

We have structured our Financial and Insurance Services Sales Program to enable every employee the opportunity to succeed in sales. In order for people to thrive in a sales training program, they need to be comfortable in understanding the content, feel included as the training progresses and feel capable of applying the content to achieve best results. Our training embodies this approach to learning.

“I enjoyed this training more than I can put into words. Naomi helped me to better understand myself and the decisions that I make as a leader. She showed me that I need to trust and back myself. The sessions helped me to understand the way other people deal with different situations which helps me to adjust the way I approach co-workers and deliver information.”

Terri Keskinen – Code Property Group

#4

Positive customer outcomes should be a central factor in the sales process.

Customer needs are rapidly changing. Coupled with the rapid rise in automations and artificial intelligence, the desire for positive human interactions will become a competitive advantage for financial and insurance institutions. Reputational damage from poor quality or inconsistent service to customers can be crippling and have a negative long-term impact.

Our program is critically focused on the needs and outcomes of your customer and how your sales teams can drive customer satisfaction. We help your staff to create quality needs-based conversations with your customers to uncover what is most important to them and how they manage their finances. This helps to strengthen the connection between your brand and your customer, furthermore building trust and advocacy.

“Excellent. Very credible as Naomi has past experience as a lender/leader/coach. Great rapport building with the class. I loved the content and found the course to be very beneficial to our current roles.”

Michelle Kuskie – Heritage Bank

#5

At the end of the day, sales training needs to drive a commercial outcome to ensure stability and sustainability.

Like any organisation, financial and insurance institutions need to drive sustainable business outcomes. With KPI’s across acquisition and retention, sales staff need to be on the ball and constantly one step ahead of their customers, knowing how, when and what to ‘sell’ next. Lost opportunities often come from sales staff unable to identify customer needs or offering to provide solutions.

Great Sales People don’t just “Wing It” when it comes to creating results that matter – they are prepared, they have a plan, they have practiced and they are ready to sell professionally.

Our Financial and Insurance Services Sales Program takes a deep dive into the sales process, from identifying the target customer, finding prospects, qualifying customers and then converting customers. We empower your sales team to feel confident in reaching their KPI’s, without the need for overly salesy and off-putting language.

“Fantastic – Naomi – you are so relevant and down to earth – truly refreshing. You are very relatable and friendly – thank you. Great to gather other people’s opinions and thoughts – always learn more that way. A great learning activity.”

Debbie Lucas – Master Electricians Australia

HOW MUCH DOES SALES TRAINING COST?

At SHINE Executive we tailor sales training to your specific organisation's challenges and objectives. For this reason, we provide tailored quotes and timeframes.

Please complete the enquiry form, and a member of the SHINE Executive team will respond to you as soon as possible

P: 0423 936 090

WE HAVE HELPED MANY AUSTRALIAN BUSINESSES SHINE

MEET NAOMI OYSTON

EXPERT SALES COACH

SUNSHINE COAST & BRISBANE

Naomi Oyston has over 25 years of sales & leadership experience within the Corporate, Financial and SME Business sectors.

Naomi has had extensive Executive Coaching success, with direct responsibility for leading the implementation & performance assessment of Customer Service Excellence, Sales Performance, Productivity & Leadership training within Commonwealth Bank, Suncorp and Heritage Bank.

Prior to establishing her Sales Leadership Consultancy, she has previously operated her own successful Commercial Finance Broking business, and also worked within leading financial institutions servicing the SME Sector, and knows first hand the challenges of creating a sustainable, profitable operation based on strong business-to-business relationships.

Having personally dealt with thousands of business owners, Naomi has a strong understanding of the drivers of Small to Medium Business, has been a judge on the Telstra Business Women’s Awards, AIM Leadership Excellence Awards and is recognised on the Who’s Who of Australian Women for her contribution to mentoring Women in the financial & business sectors.

As a Sales Leadership Coach, Naomi is passionate about assisting her clients to focus on results that matter. She creates continuous incremental improvement through combining street proven systems & processes with exemplary people skills and a culture of sustainability, using a Head, Heart & Soul approach to success.

HOW WE DEVELOP AND DELIVER OUR PROGRAMS

Program Development

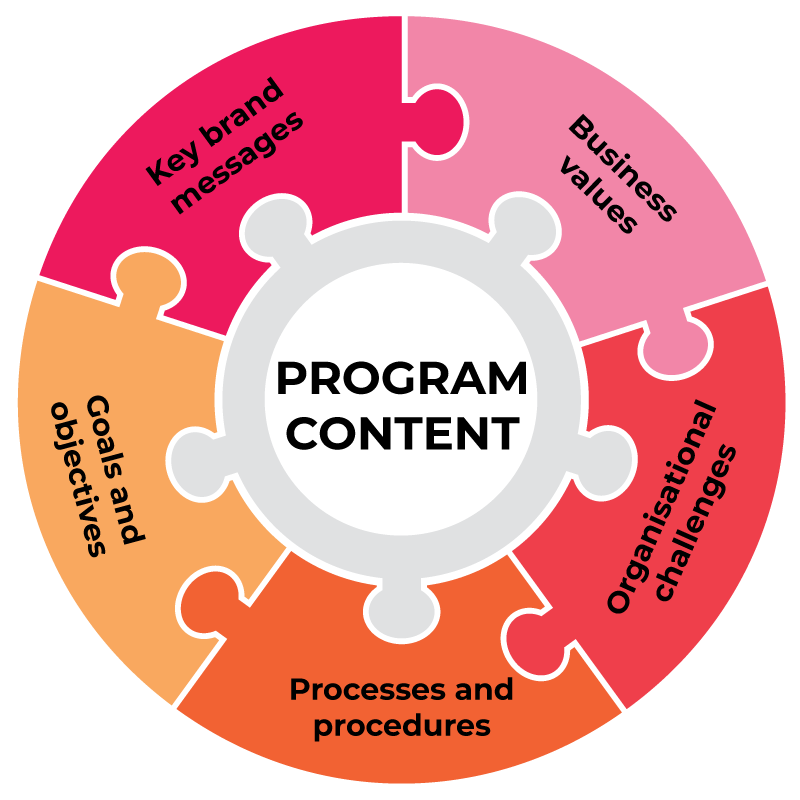

We understand that every organisation is different – differing business models, operating systems and processes, types of employee roles, unique challenges and goals. For this reason, we at SHINE Executive tailor each of our programs in consultation with our clients, incorporating key brand messages, values and procedures in the program content.

Program Delivery

Phase One

In Phase One, we start by designing a conversation framework in consultation with key stakeholders. This would include, but not be limited to:

- Brand messaging and values

- Product features

- Benefits to customers

Phase Two

In Phase Two, we will assist with the development of necessary training procedures, sales manuals and collateral that can be used as part of new staff on-boarding and existing staff upskilling.

Phase Three

Phase Three is the delivery of the Leadership GROWTH Coaching Program, where we implement the quality conversations developed in Phase One. At this point, we will discuss how specific legislation might impact conversations. This phase will be supported with learning materials which include:

- Power phrases

- Influencing language

- Quality questions

- Clues and opportunity identifiers

- Conversation starters

Phase Four

In our final phase, we conduct relevant assessments to demonstrate a positive return on investment (ROI) for our client.

Organisations are rightfully seeking an ROI on sales training, and this only comes from measuring relevant criteria

Sales training effectiveness can be measured in any number of ways, depending on the exact factors you want to track. Trough our tailored programs, we can design assessment criteria unique to your organisation and sales goals.

Assessment is not only important for new sales starters, but also for seasoned sales leaders (or someone who has come from a competing organisation); over time, people can develop their own ‘style’ of selling that they think is competent, but if they are never measured or assessed on the success of their technique it can be difficult to measure performance and/or manage issues.

VIEW OUR OTHER SALES TRAINING AND LEADERSHIP COACHING PACKAGES

Professional Sales and Services Program

Our Professional Sales and Services Program focuses on problem solving and how to effectively identify a customer’s pain points and provide a solution to meet that specific customer need. The Program components include a Culture Survey, Sales Strategy, Sales Leadership and Delivering Service Excellence.

Emerging Leaders Mentoring Program

The Emerging Leader Program provides new and transitioning leaders the foundational skills and confidence to build successful leadership skills and an appreciation of what it takes to be a great leader.

Women in Leadership Program

Financial and Insurance sectors are bound by complex legislation. This legislation creates challenges for sales teams. Our Financial and Insurance Services Sales Program has been specifically designed to meet the complex needs of businesses within this sector.

DiSC Profiles

Combine your chosen Sales Training Program with DiSC profiles for your sales teams. DiSC profiles help participants better understand themselves and others. Choose from seven different applications, depending on your objectives and environment.